The Canadian Vanguard Stock Market Report At Market Close – Wednesday, April 24, 2024 .

.

Data Driven Stock Market Analysis And Report

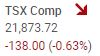

The Toronto Market

The TSX blinked today after four successive sessions of gains. The index declined 138.00 points or -0.63% to close today’s market session at 21,873.72 today.

The market was mixed today and only five of the major sectors ended the session in green. Today the buzz at the market was mostly about Durable Consumer Goods & Services and the sector, in sync with the day’s market buzz lead the sectors with 0.63% gain. Utilities gained 0.25%; Energy gained 0.22%; Basic Materials was up 0.18% and Discretionary Consumer Goods & Services was up 0.16%. Healthcare declined -0.27%; Financials was down -0.56%; Technology declined -1.17% – whatever the sector gained yesterday was thrown back out today. Industrials sector declined -2.30%. The data shows a bearish market day indeed.

Consumer Electronics industry gained a hefty 25%; Office Equipment followed with 2.64%; Construction Materials gained 2.55%; Auto & Truck Manufacturers gained 2.39% and Retail – Discount Stores was up 1.72%. Discount Stores have been consistent in appearing in our list of performing industries. Two members of that industry are Dollarama (TSX:DOL) and PesoRama Inc. (TSX:PESO).

Computer Hardware gained 9.63%; Industrial Machinery & Equipment was up 4%; Coal was up 3.34%; Publishing was up 2.71%, while Chemicals – Agriculture was up 1.65%.

Today’s Statistics: Today, the declined issues (Decliners) prevailed over the gaining issues (Advancers). The ratio of Decliners to Advancers was 1.80-to-1.0 or in practical terms, for every nine Decliners there were five Advancers. In real numbers, 748 Decliners to 650 Advancers with 140 Unchanged. The total volume of shares traded for gaining stocks was 114,843,461 or 39.6%, the total volume for declined stocks was 162,673,239 or 56.0% and 12,792,850 or 4.4% for “Unchanged”.

There were 25 new 52-Week Highs and 5 new 52-Week Lows. Yesterday, there were 18 new 52-Week Highs and 26 new 52-Week Lows. This aspect of the market was bullish today.

The total volume of stocks traded at the TSX today was 290,309,550 compared to 308,441,962 yesterday, a 7% percent decrease. Today’s volume of 290,309,550 was fifteen percent lower than the average of the ten most recent market sessions.

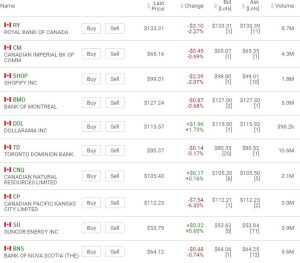

The US Markets

The US markets’ index had mixed results today. The Dow Jones Industrial Average declined -42.77 points or -0.11% to close at 38,460.92 . The S&P 500 was able to eke out a gain of 1.08 points, or -0.02%, to close at 5,071.63. The Nasdaq Composite finished 16.11 points or 0.10%, to close at 15,712.75.

Six of the US markets major sectors gained today. Durable Consumer Goods & Services gained 0.78%; Utilities sector gained 0.50% while Discretionary Consumer Goods & Services gained 0.34%; Basic Materials was up 0.07% while Energy gained 0.04% and Technology was up a paltry 0.02%. Telecommunications Services declined -0.21%; Financials was down -0.21%; Healthcare was down -0.40% and Industrials sector declined -0.62%.

Auto & Truck Manufacturers industry was up 5.44%; Marine Port Services, down -7.50% on yesterday was up 2.41% today; Rails & Roads – Passengers was up 2.38%; Beverages – Non Alcoholic was up 2.12% while Media Diversified was up 1.39%.

Today’s Market Statistics: Today, the declined issues (Decliners) outnumbered the gaining issues (Advancers) on the NYSE. The ratio of Decliners to Advancers was 1.32-to-1.0 or in practical terms, approximately for every thirteen Decliners there were ten Advancers. In real numbers, 2,260 Decliners to 1,705 Advancers with 306 Unchanged. The total volume of shares traded for gaining stocks was 477,780,762 or 48.4%; the total volume for declined stocks was 495,787,339 or 50.2% and 13,777,511 or 1.4% for “Unchanged”.

There were 80 new 52-Week Highs and 50 new 52-Week Lows. Yesterday, there were 34 new 52-Week Highs and 95 new 52-Week Lows.

The total volume of stocks traded at the NYSE today was 987,354,612 compared with 950,041,971 yesterday, a 2.4% increase. Today’s volume of 987,354,612 is about 0.01% lower, really negligible, than the average of the ten most recent market sessions.

On the NASDAQ, the Decliners prevailed over the Advancers today by a ratio of 1.21-to-1 or roughly for every six Decliners there were five Advancers. In real numbers, there were 2,316 Decliners to 1,903 Advancers with 330 Unchanged. The total volume of volume-gaining stocks was 2,451,122,242 or 49.7%; the total volume of declined-volume stocks was 2,410,201,382 or 48.8% and 73,260,495 or 1.5% for “Unchanged”.

There were 55 new 52-Week Highs and 120 new 52-Week Lows. Yesterday, there were 80 new 52-Week Highs and 50 new 52-Week Lows.

The total volume of stocks traded at the NASDAQ today was 4,934,584,119 compared to 5,083,746,770 yesterday, a 3.4% decrease. Today’s volume of 4,934,584,119 is about one percent lower than the average of the last ten market sessions.

Stocks In The News/Stocks To Watch

The Toronto Market

The stocks of Canadian big banks came under pressure today. Royal Bank (TSX:RY) declined -2.27% or $3.10 to close at $133.31 with 8.7M shares changing hands today. The volume of RY shares traded today was more than double the daily average in the last 50 days. In the meantime Dollarama (TSX:DOL) continues its steady climb upwards slowly but steadily, gaining 37.5% in the last eleven months.

The US Markets

In the news today and worth adding to your watchlist is a company from “the East”. Futu Holdings (FUTU) is a tech-driven online brokerage and wealth management platform. The company announced today that it had filed its annual report on Form 20-F for the fiscal year ended 31st, December 2023. FUTU was up today 3.31% or $2.05 to close at $63.98 with 3.1M shares traded.

Meta Platforms (META) fell solidly at the after-hours market. META closed at $493.50 at the close of the regular market session. The stock was changing hands at $418 at around 8pm at the after-hours market. The company, after market close, issued a relatively weak guidance on its near term market view.

.

Regular Market Day Features

Beginner Investor’s (Canadian stocks) Watchlist

The Canadian Vanguard Chinese Stocks Watchlist

EV, Energy and Resource Stocks Watchlist

MPORTANT NOTICE

Readers are reminded that the market’s performance at the following day’s market session may completely differ from the market performance at the overnight markets.

SUBSCRIPTION Offer: We thank you for following our Stock Market posts but please be aware that we shall soon be restricting these articles to subscribers only.

We do not send this publication by email to readers. If you receive a copy by email please simply forward the email to us.

Our reports are composed by humans after proper analysis and detailed research. It is neither AI nor machine generated. We do not, like AI, make things up.