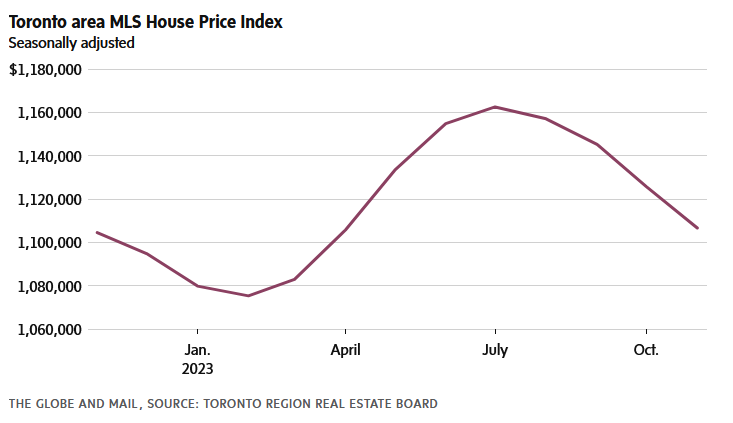

Toronto housing market ticked up in November but prices drip for the fourth consecutive month

Toronto home sales rose in November after five months of declines, but property prices fell further as competition waned among buyers.

The number of Toronto-area purchases rose 1.7 per cent from October to November, though were still 30 per cent below the 10-year average, according to the Toronto Regional Real Estate Board (TRREB). The last time sales increased was in the April to May period, the month before the Bank of Canada surprised the housing market with an interest-rate hike.

TRREB’s chief market analyst cautioned against reading too much into the tiny monthly increase in sales. “A one-month change in direction doesn’t necessarily mark a trend,” Jason Mercer said.

Fewer homeowners put their properties up for sale last month. New listings were down 5.5 per cent from October to November, though the volume of properties on the market remains higher than earlier this year, when buyers had rushed back into the market after last year’s lull in activity.

Home prices fell for the fourth straight month in November. The home price index for the Toronto region, which removes the highest-priced properties, was $1,106,600 last month, a 1.7-per-cent decline from October, though on par with pricing in April.

TRREB expects home prices to rebound when mortgages start to become cheaper. It also expects record-high immigration levels to continue to bolster demand for housing. “Expect demand to increase relative to supply. This will eventually lead to renewed growth in home prices,” Mr. Mercer said in a news release.

The central bank’s final scheduled interest-rate announcement for 2023 is this Wednesday, and it is expected to keep its benchmark interest rate steady at 5 per cent.

That may encourage potential buyers to start making purchases again. Though with the popular five-year fixed rate mortgage still at more than 6 per cent, would-be buyers are having a hard time qualifying for a large enough mortgage to buy in the Toronto region.

Mr. Mercer said buyer sentiment will likely change when the central bank makes its first interest-rate cut, which economists widely expect next year.

In Vancouver, sales fell 14 per cent in November over October and were about one-third lower than the 10-year average for November. The home price index eased 1 per cent to $1,185,100, with declines across detached houses, semi-detached and condos.

At the same time, new listings also dropped, falling 27 per cent in the month.

This article was reported by The Globe and Mail