The Canadian Vanguard Stock Market Report At Close – Thursday, February 1, 2024

.

Data Driven Market Analysis And Report For Tomorrow’s Winning Trades

.

The Toronto Market

The TSX composite index was up 97.33 points or 0.46% to close today’s market session at 21,119.21. The market today was positive even though the total volumes of shares traded during the session was ten per cent lower compared to yesterday.

Seven of the major sectors of the TSX were up today. Basic Materials, comprising mining companies and related, was the top performer at the market session. The sector was up 2.47%; Industrials gained 1.79%; Healthcare was up 1.69%; Durable Consumer Goods & Services was up 1.49% and Utilities gained 0.94%. Financials, Energy and Technology were down -0.04%, -0.43% and -1.39% respectively.

Retail – Apparel & Accessories was up 6.93%; Aluminum gained 5.26%; Coal gained 4.07%; Pharmaceuticals – Generic & Specialty was up 3.97% while Electrical Components & Equipment gained 3.90%. The top gaining industries yesterday were the biggest decliners today: Marine Port Services declined -3.35%; IT Services & Consulting declined -3.02%; Oil & Gas Drilling declined -3% while Media Diversified declined -1.89%.

Today’s Statistics: The gaining issues (advancers) outnumbered the declined issues (decliners) today. The ratio was 3.01-to-1.0 or roughly for every advancers there was one decliner. In real numbers, 1,147 advancers to decliners to 381 with 88 Unchanged. The total volume of shares traded for gaining stocks was 193,221,152 or 63.2%; the total volume for declined stocks was 108,043,970 or 35.4% and 4,288,549 or 2.21.4% for “Unchanged”.

There were 105 new 52-Week Highs and 18 new 52-Week Lows.

The total volume of stocks traded at the TSX today was 305,553,671 compared with 338,622,105 on Monday, a 10% decrease. Today’s volume of 338,622,105 was just about the average of the ten most recent market sessions.

The US Markets

The Dow Jones Industrial Average was up 369.54 points, or 0.97%, to close at 38,519.84. The S&P 500 was up 60.54 points, or 1.25%, to close at 4,906.19. The Nasdaq Composite gained 197.63 points or 1.3%, to close at 15,361.64. The market trend remains positive but the bullish sessions are happening with low traded volume of shares while sessions with declines are happening with higher trading volumes. That is not a good sign.

The market has now settled in to the pattern whereby one day the market is down with large volume of shares traded, the following day the market is up but with the volume of shares traded down considerably. The market appears not ready to make up its mind. Yesterday the indexes were down and the volume was up. Today, the indexes gained but the volume of shares traded was down by ten percent. This type of market behavior calls for extra care on the part of traders as the market can spin a trick at a moment’s notice.

It was a broad-based positive market session. All sectors of the US market ended the market session with gains. Utilities led the gainers with 1.93% gain. Durable Goods & Services gained 1.87%; Basic materials was up 1.70%; Industrials was up 1.63%; Technology gained 1.31%; Telecommunication Services gained 1.19%; Energy gained 0.18% and Financials gained 0.13%.

Today’s Market Statistics: Today, the gaining issues (advancers) totally outnumbered the declined issues (decliners) on the NYSE by a ratio of 3.42-to-1 or roughly for every seventeen advancers there were five decliners. In real numbers, there were 3,163 advancers to 923 decliners and 220 “Unchanged”. The total volume of volume-gaining stocks was 755,765,674 or 70.9%; the total volume of declined-volume stocks was 306,231,340 or 28.7%; and 4,608,956 or 0.4% “Unchanged”.

There were 266 new 52-Week Highs and 48 new 52-Week Lows. It was a bullish market performance today. Yesterday’s market was driven by Feds chairman’s comments about the likelihood of any lowering of interest rate not happening soon. Today the market was driven by earnings reports.

The total volume of stocks traded at the NYSE today was 1,066,605,970 compared with 1,381,995,808 yesterday, a 23% decrease. Today’s volume of 1,066,605,970 is about the average of the ten most recent market sessions.

On the NASDAQ, the advancers outnumbered the decliners by a ratio of 2.84-to-1 or roughly for every fourteen advancers there were five decliners. In real numbers, there were 2,790 decliners to 1,517 advancers with 309 unchanged. The total volume of volume-gaining stocks was 3,550,767,301 or 68.3%; the total volume of declined-volume stocks was 1,605,598,841 or 30.9% and 45,887,075 or 0.9% for “Unchanged”.

There were 115 new 52-Week Highs and 131 new 52-Week Lows. This is bearish but the difference between the two data is small, also the other market data today were bullish. The market appears to be struggling to maintain the rally.

The total volume of stocks traded at the NASDAQ today was 5,202,253,217 compared with 5,984,789,632 yesterday, a 13% decrease. Today’s volume of 5,202,253,217 is slightly lower than the average of the ten most recent market sessions.

The market outlook remains trade with caution.

10 –year Treasury Yield: The 10-year Treasury yield climbed a few basis points to 3.89%.

Regular Market Day Features

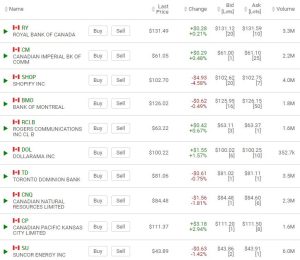

The Canadian Vanguard Beginner Investor’s (Canadian Stocks) Watchlist

The Canadian Vanguard Chinese Stocks Watchlist

EV, Energy and Resource Stocks Watchlist

IMPORTANT NOTICE

Readers are reminded that the market’s performance at the following day’s market session may completely differ from the market performance at the overnight markets.

SUBSCRIPTION Offer: We thank you for following our Stock Market posts but please be aware that we shall soon be restricting these articles to subscribers only.

We do not send this publication by email to readers. If you receive a copy by email please simply forward the email to us.

Our reports are composed by humans after proper analysis and research. It is neither AI nor machine generated. We do not, unlike AI, make things up.