The Canadian Vanguard Stock Market Report At Close – Tuesday, February 20, 2024

.

Data Driven Market Analysis And Report For Tomorrow’s Winning Trades

.

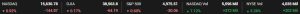

The Toronto Market

The TSX composite index declined -38.08 points or -0.18% to close today’s market session at 21,217.53. The total volume of shares traded for the day increased and was much higher compared with the volume traded on Friday. The market was closed yesterday. This is in line with the recent market trend where volume was down on days when the index gained and the volume was up on the days when the index declined. Investors appear reluctant in pushing the stock prices higher even though the market rally appears to be moving along well.

Today’s Statistics: The declined issues (decliners) edged out the gaining issues (advancers) today. The ratio decliners to advancers was 1.05-to-1.0 or in practical terms, for every twenty one decliners there were twenty advancers. In real numbers, 774 decliners to 739 advancers with 121 Unchanged. The total volume of shares traded for gaining stocks was 152,384,959 or 44.7%; the total volume for declined stocks was 171,799,265 or 50.4% and 16,919,635 or 5.0% for “Unchanged”.

There were 149 new 52-Week Highs and 22 new 52-Week Lows.

The total volume of stocks traded at the TSX today was 341,103,859 compared with 291,362,426 on Friday, a 19% increase, a better than full reversal of the decline in volume at the previous market session. Today’s volume of 341,103,859 was slightly higher than the average of the ten most recent market sessions.

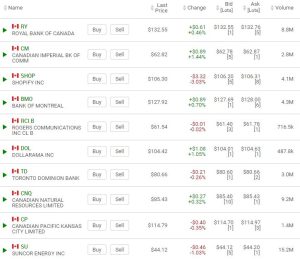

The US Markets

The Dow Jones Industrial Average declined -64.19 points, or -0.17%, to close at 38,563.80. The S&P 500 declined -30.06 points, or -0.60%, to close at 4,975.51. The Nasdaq Composite was down -144.87 points or -0.92%, to close at 15,630.78. All three indexes were down today, making it the second consecutive session during which all the indexes were down.

All US markets were negative today. The indexes not only closed in the negative but were negative throughout the market session.

Today’s Market Statistics: Today, the declined issues (decliners) definitely outnumbered the gaining issues (advancers) on the NYSE by a ratio of 1.42-to-1 or for every seven decliners there were five advancers. In real numbers, there were 2,374 decliners to 1,665 advancers and 280 “Unchanged”. The total volume of volume-gaining stocks was 357,810,105 or 34.5%; the total volume of declined-volume stocks was 672,050,918 or 64.7%; and 8,487,106or 0.8% “Unchanged”.

There were 228 new 52-Week Highs and 42 new 52-Week Lows. The market rally continues but the bears did bare their teeth today.

The total volume of stocks traded at the NYSE today was 1,038,348,129 compared to 1,036,591,557 on Friday, practically no change. Today’s volume of 1,038,348,129 is about 3% higher than the average of the ten most recent market sessions.

On the NASDAQ, the decliners outnumbered the advancers today by a ratio of 1.88-to-1 or roughly for every nineteen decliners there were ten advancers. In real numbers, there were 2,816 decliners to 1,500 advancers with 304 unchanged. The total volume of volume-gaining stocks was 2,389,151,774 or 41.7%; the total volume of declined-volume stocks was 3,218,970,534 or 56.2% and 124,444,001 or 2.2% for “Unchanged”. The volume for “Unchanged” today was doubled the volume for “Unchanged” on Friday, the last previous market session.

On Thursday, there were 354 new 52-Week Highs and 53 new 52-Week Lows. On Friday, there were 229 new 52-Week Highs and 66 new 52-Week Lows. Today, there were 111 new 52-Week Highs and 95 new 52-Week Lows. The bears did bare their teeth today but did not “bite hard” as indexes closed well off the market session’s lows.

The total volume of stocks traded at the NASDAQ today was 5,732,566,309 compared to 5,327,181,736 yesterday, a 5% increase. Today’s volume of 5,732,566,309 is just one percent higher than the average of the last ten market sessions.

10 –year Treasury Yield: The US 10-year Treasury yield fell back to 4.28% today. The five-year Treasury yield closed at 4.247%, down from 4.290% on Friday.

The market outlook remains trade with caution.

Last week, the indexes climbed to or remained at new highs. Today, even with the market indexes’ declines, there were no major or sensational declines and indexes closed well off the session’s lows. However, it is time to be very cautious with trades. It is certainly time to avoid adventurous or overly aggressive trades. Most of the big name stocks came off the session’s lows. The good news is that the declines today will allow stocks to rise again without getting extended. The declines for the indexes came with increased volumes traded. That has been the pattern the last three weeks. For investors, the message from the market is that it is time to be cautious.

Be ready to act as quickly as possible when necessary if you are making new stock purchase.

Regular Market Day Features

Beginner Investor’s (Canadian stocks) Watchlist

The Canadian Vanguard Chinese Stocks Watchlist

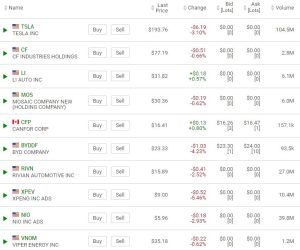

EV, Energy and Resource Stocks Watchlist

IMPORTANT NOTICE

Readers are reminded that the market’s performance at the following day’s market session may completely differ from the market performance at the overnight markets.

SUBSCRIPTION Offer: We thank you for following our Stock Market posts but please be aware that we shall soon be restricting these articles to subscribers only.

We do not send this publication by email to readers. If you receive a copy by email please simply forward the email to us.

Our reports are composed by humans after proper analysis and detailed research. It is neither AI nor machine generated. We do not, unlike AI, make things up.